Vestar Capital Partners Acquires Stratus, a Global Leader in Brand Implementation and Facilities Services, from Arcapita

NEW YORK, July 7, 2021 /PRNewswire/ — Vestar Capital Partners (“Vestar”), a leading middle-market private equity firm, announced today that it has acquired Stratus (or “the Company”), a market-leading asset-light facilities services provider, from Arcapita Group Holdings (“Arcapita”), a global alternative investments firm. Terms of the transaction were not disclosed.

CEO and founder Tim Eippert and the Company’s senior leadership team will continue to lead Stratus and will reinvest in the transaction alongside Vestar. Arcapita will also retain a minority stake in the Company.

Founded in 1953 and based in Mentor, OH, Stratus serves a highly diversified base of blue-chip customers including some of the leading Fortune 100 brands in 50 states and 24 countries across a broad range of end markets, including healthcare, financial services, QSR, convenience stores, and telecom. The Company offers best-in-class customer service and integrated solutions, enabled by a differentiated technology suite and unmatched expertise and scale. Under Arcapita’s ownership, Stratus more than tripled its revenue to over $300 million, while completing multiple add-on acquisitions to expand the Company’s customer base and product offerings.

“Stratus is fortunate to have found a true partner in Vestar, which shares our customer-centric philosophy and vision for growth, and has a deep understanding of our industry,” said Mr. Eippert. “We look forward to leveraging Vestar’s strategic relationships, capital, and operational expertise alongside our ongoing partnership with Arcapita, working together to continue building our capabilities for the benefit of our valued customers.”

“Stratus’ significant investments in systems and operational infrastructure, deep understanding of its customers’ needs, and relentless focus on service excellence have enabled its growth into a scaled nationwide platform,” said Nikhil Bhat, Vestar Managing Director and Co-Head of Business & Technology Services. “The Company has an attractive opportunity to expand into complementary service lines and reinforce its current offerings through acquisition and continued investment in the platform. We are excited to partner with Tim and his exceptional management team to help accelerate the next stage of Stratus’ growth.”

Martin Tan, Arcapita’s Chief Investment Officer, commented, “Arcapita is extremely proud of Stratus’ transformation into the leading national brand implementation company that it is today. With Arcapita’s support, Stratus has been able to expand its services and product offerings, as well as expand its footprint across the US. Stratus’ success is a testament to Arcapita’s dedicated approach of investing in good companies and providing them with the resources to realize their ambitions. We are confident that with the current strength of the Stratus bench and Vestar’s added support, the Company will continue to enjoy the rapid growth we have achieved, in the coming years.”

William Blair and Citizens M&A Advisory acted as financial advisors and King & Spalding served as legal counsel to Stratus. Robert W. Baird & Co. acted as financial advisor and Kirkland & Ellis LLP served as legal counsel to Vestar.

About Stratus

Stratus is a leading brand implementation and facilities services company offering signage solutions, energy services, repair and maintenance programs, and refresh and remodel capabilities across 50 states and 24 countries. With more than 50,000 projects completed annually, the Company provides versatile solutions for some of the world’s largest and most recognized brands. For more information, please visit www.stratusunlimited.com.

About Vestar Capital Partners

Vestar Capital Partners is a leading U.S. middle-market private equity firm specializing in management buyouts and growth capital investments. Vestar invests and collaborates with incumbent management teams and private owners to build long-term enterprise value, with a focus on Consumer, Business & Technology Services and Healthcare. Since its founding in 1988, Vestar funds have invested $8 billion in 85 companies – as well as more than 200 add-on acquisitions – with a total value of approximately $50 billion. For more information on Vestar, please visit www.vestarcapital.com.

About Arcapita

Arcapita is a global alternative investment manager, with offices in Atlanta, London and Singapore and an affiliated office in Bahrain. Arcapita’s principal lines of business are private equity and real estate, and its management has a 24-year track record of over 90 investments with total transaction value in excess of $30 billion. Further details on Arcapita can be found at www.arcapita.com

Media Contacts

For Vestar:

Lambert & Co.

Jennifer Hurson

845-507-0571

[email protected]

or

Caroline Luz

203-656-2829

[email protected]

For Arcapita

Tariq Hayat

+973 17 218 858

Mobile +973 39 461103

[email protected]

or

Brunswick

Ailsa Martin

+971 4 560 5900

[email protected]

LERETA Announces Sale To Flexpoint Ford And Vestar Capital Partners

COVINA, CA, July 6, 2021– LERETA, LLC (“LERETA” or “the Company”), a leading national provider of real estate tax and flood services for mortgage servicers, and its equity holders, including funds managed by Tarsadia Investments, LLC, announced today that they have reached an agreement to sell the Company to private equity firms Flexpoint Ford and Vestar Capital Partners. The transaction is expected to close within 30 days.

LERETA’s chief executive officer, John Walsh, and the current senior management team will continue to lead the Company.

LERETA serves more than 4,000 customers nationwide. The Company processes more than $17 billion in tax payments annually and monitors more than 25 million loans for flood determinations. Over the past two years, the Company has met 99.9% of its service level agreements for all customers.

Commenting on the transaction, Walsh said, “Flexpoint Ford and Vestar Capital Partners represent an ideal partnership for LERETA. The combination of these two well-regarded firms provides deep experience in financial services and a wealth of knowledge around scaling and enhancing technology. LERETA has distinguished itself by providing a high level of customer service in our markets. As a result, we’ve been successful in adding new customers and building market share. This transaction will enable us to accelerate our already strong growth, step up our investments in technology and scale our operations to address the changing needs of the mortgage servicing industry.”

“We found that LERETA’s customers really valued its flexibility, attentiveness and white-glove customer service. The Company’s planned increase in technology investments will continue to further enhance its customers’ experience,” said Steve Begleiter, Managing Director at Flexpoint Ford. “We are thrilled to partner with John, the LERETA team and Vestar in the next chapter of LERETA’s success. The Company’s focus on providing best-in-class service and the planned investment in its technology positions the business for an exciting future,” added Arjun Thimmaya, Managing Director, Flexpoint Ford.

“LERETA’s robust systems and service-oriented, client-first approach have enabled the Company to deliver high-quality, regulatory-compliant solutions for its customers’ most complex needs for over 35 years,” said Nikhil Bhat, Managing Director and Co-Head of Business & Technology Services at Vestar Capital Partners. “We are excited to support management as they accelerate the Company’s technology investments, further enhancing the speed, accuracy, and reliability of LERETA’s products while facilitating seamless integration with customers’ mission-critical workflows.”

Financial details of the transaction were not disclosed.

Rothschild & Co served as the lead financial advisor to LERETA and its board of managers, and Kirkland & Ellis, LLP served as legal counsel to LERETA. American Discovery Capital also served as a financial advisor to LERETA and its board of managers. Raymond James served as financial advisor to Flexpoint Ford and Vestar Capital Partners. Wachtell, Lipton, Rosen & Katz served as legal counsel to Flexpoint Ford. Kirkland & Ellis, LLP served as legal counsel to Vestar Capital Partners.

About LERETA

Since 1986, LERETA has provided the mortgage and insurance industries the fastest, most accurate and complete access to property tax data and flood hazard status information across the U.S. LERETA is committed to giving customers extraordinary service and cost-effective property tax and flood solutions. LERETA’s services are designed to increase efficiency, reduce penalties and liabilities and improve processes for mortgage originators and servicers. LERETA’s dedicated teams of real estate tax and flood professionals along with LERETA’s experienced management team allow the company to lead the industry in service and technology.

Flexpoint Ford is a private equity investment firm that has raised more than $5 billion in capital and specializes in privately negotiated investments in the financial services and healthcare industries. Since the firm’s formation in 2005, Flexpoint Ford has completed investments in more than 40 companies across a broad range of investment sizes, structures and asset classes. Flexpoint Ford is headquartered in Chicago, Illinois, with additional offices in New York, New York. For more information about Flexpoint Ford, please visit www.flexpointford.com.

About Vestar Capital Partners

Vestar Capital Partners is a leading U.S. middle-market private equity firm specializing in management buyouts and growth capital investments. Vestar invests and collaborates with incumbent management teams and private owners to build long-term enterprise value, with a focus on Business & Technology Services, Consumer, and Healthcare. Since its founding in 1988, Vestar funds have invested $8 billion in 85 companies – as well as more than 200 add-on acquisitions – with a total value of approximately $50 billion. For more information on Vestar, please visit www.vestarcapital.com.

About Tarsadia Investments

Tarsadia Investments is the California-based investment management company of a single-family office. Tarsadia Investments has a flexible and long-duration investment mandate that enables it to invest across multiple stages of maturity and asset classes. Its current portfolio includes majority investments in privately held companies and minority investments in venture- and growth-stage businesses.

###

Media Contact:

Bill Campbell

Campbell Lewis

212-995-8057

Accanto Health Announced As Company Name For Recently Merged Veritas Collaborative and The Emily Program

ST. PAUL, Minn., June 29, 2021 /PRNewswire/ -- The recently merged Veritas Collaborative and The Emily Program today announced the name of its parent company, unveiling "Accanto Health." Accanto, which means "beside" in Italian, represents the company's commitment to be with those they serve the whole way on their journey. Accanto Health will maintain both brand names of its leading eating disorders programs, The Emily Program and Veritas Collaborative.

"Everyone we serve is on a journey, whether early on in that journey or further along. We believe we are building a relationship with them to help them get to a better place. The impact we have will last a lifetime," said Dave Willcutts, CEO of the newly named Accanto Health. "We want to be beside everyone we serve for as much of the journey as they need our help."

Accanto will retain the highly respected The Emily Program and Veritas Collaborative brands in their respective markets across Georgia, Minnesota, North Carolina, Ohio, Pennsylvania, Virginia, and Washington. Accanto is committed to expanding access to care while maintaining the highest level of clinical integrity and treatment standards.

"We know clients and families rely on The Emily Program and Veritas Collaborative brands to deliver warm, high-quality expertise, care, and support," said Willcutts. "We will continue to work to exceed their expectations as they put their trust in us to be with them the whole way in recovery. We also know the need for eating disorder treatment exceeds the availability of services. Accanto is committed to bringing care to more people in more places."

About Accanto Health

Accanto Health, based in St. Paul, Minnesota, is a national healthcare company specializing in eating disorders and related disorders, with two nationally known eating disorder brands, The Emily Program and Veritas Collaborative, collectively offering care in 20 locations across 7 states: Georgia, Minnesota, North Carolina, Ohio, Pennsylvania, Virginia, and Washington. Recognizing that one size does not fit all, Accanto Health programs provide exceptional, individualized care for people with eating disorders of all ages in a gender-diverse and inclusive environment, incorporating an array of individual, group, and family therapy, nutrition, psychiatry, medical care, yoga, education, and support services. Services are offered across a full continuum of care including inpatient, residential, partial hospitalization, intensive outpatient, and outpatient. If you or someone you know is struggling with an eating disorder, call 1-888-EMILY-77 or visit accanto.com

###

Contact: [email protected] or Jillian Lampert, Chief Strategy Officer, 651.428.4654

SOURCE Accanto Health

Related Links

Vestar Capital Partners Names Jane Larsen Wildman as a Senior Advisor

NEW YORK, June 7, 2021 /PRNewswire/ -- Vestar Capital Partners ("Vestar"), a leading middle-market private equity firm, today announced that Jane Larsen Wildman has joined the firm as a Senior Advisor focused on the beauty and personal care ("BPC") sector. Ms. Wildman will work closely with Vestar's Consumer Group to actively seek and evaluate new investment opportunities in the BPC sector and help portfolio companies enhance their strategy and operations.

Ms. Wildman brings over 30 years of experience in global BPC, having led companies on strategy, brand building, channel expansion, and digital transformation. Her category experience includes hair, skin, feminine, health, baby, and men's personal care, as well as plant-based proteins, vitamins, and food. Most recently, Ms. Wildman served as President and board member of Combe Inc., a family-owned personal care business. Prior to Combe, she was a Partner at The Partnering Group, where she worked with start-ups, leading retailers, and Fortune 50 companies. She spent more than 25 years at Procter & Gamble, where she served as General Manager of Beauty Care, and Global Vice President and Chief Marketing Officer for Baby Care. During her tenure, P&G became the leader in global hair care and doubled the scale of its baby care business unit. Jane currently serves on the advisory boards of the Association for National Advertisers' Alliance for Inclusive and Multicultural Marketing, G100's SSA Digital practice and its Women's Leadership Accelerator, among others.

"I am honored to join the Vestar team at this important time in the rapidly evolving consumer and retail markets," said Ms. Wildman. "Vestar's strong team and their strategy of building long-term enterprise value through deep partnerships with their portfolio companies attracted me to the firm. Their collaborative approach with management teams and founders is crucial in realizing maximum growth, and I look forward to working with the team to help companies achieve their goals."

"Jane has significant experience building and revitalizing brands in the beauty and personal care sector, which will be an invaluable resource for Vestar as we look to increase our investment activity in this large, growing category," said Winston Song, Vestar Managing Director and Co-head of Consumer. "Jane's operating expertise and strategic network enhances Vestar's consumer franchise and capabilities, and she will be a strong asset to our current and future portfolio company management teams."

"Given Jane's experience with both large established and smaller emerging BPC brands across omnichannel environments, she brings a wealth of knowledge that will help us evaluate opportunities in this attractive sector. We're thrilled to welcome Jane and grateful that she has chosen Vestar as her partner," said Diya Talwar, Principal in Vestar's Consumer Group.

About Vestar Capital Partners

Vestar Capital Partners is a leading U.S. middle-market private equity firm specializing in management buyouts and growth capital investments. Vestar invests and collaborates with incumbent management teams and private owners to build long-term enterprise value, with a focus on Consumer, Business & Technology Services and Healthcare. Since its founding in 1988, Vestar funds have invested $8 billion in 85 companies – as well as more than 200 add-on acquisitions – with a total value of approximately $50 billion. For more information on Vestar, please visit www.vestarcapital.com.

Media Contact

Lambert & Co.

Jennifer Hurson

845-507-0571

[email protected]

or

Caroline Luz

203-656-2829

[email protected]

SOURCE Vestar Capital Partners

Related Links

Simple Mills Partners with IRI Growth Consulting to Drive Profitable Innovation

CHICAGO – May 5, 2021 – IRI®, a fast-growing, global leader in innovative solutions and services for consumer, retail and media companies, and Simple Mills, a pioneer in the clean-food snacking space that ranks as the No. 1 baking mix, No. 1 cracker brand and No. 3 cookie brand in the natural category in over 25,000 stores nationwide, continue to expand their growth consulting partnership focused on expanding the Simple Mills portfolio and overall value proposition for retail partners and consumers. The partnership is part of IRI's efforts to guide clients of all sizes in making the most cost-effective investments in pricing, pack architecture, messaging/positioning, and product features and innovation that will strengthen their overall value proposition and profitability.

Robb Bennett, director of Insights and Analytics at Simple Mills, said, "Simple Mills partnered with IRI on a Price Pack Architecture project that drove highly actionable insights for both our current portfolio and new innovations. The IRI team mapped the current price and pack landscape, devised a custom approach to test consumer demand for new concepts across multiple retail channels, and advised on actions based on the learnings – all amid the market uncertainty of 2020. The results played a central role in developing new PPA concepts that will begin hitting the market later this year and enabled us to confidently move forward on new innovation. We greatly benefitted from the IRI team's strategic thinking, research experience and cross-category pricing expertise."

"Due to recent cost increases and shopper behavior shifts stemming from COVID-19, CPG manufacturers – especially premium players – need to strengthen their margins and justify their price positioning," said Ray Florio, executive vice president and partner of IRI Growth Consulting. "Furthermore, shoppers have become far more cynical about product claims and benefits, requiring brands to take a more sophisticated approach to communicate their true value and avoid commoditization. IRI is proud to partner with Simple Mills and other companies looking to navigate rapidly changing landscapes and make strategic growth decisions to drive sustained competitive advantage during these uncertain times."

IRI Growth Consulting is focused on supporting retail, CPG and health care companies of all sizes grow both top-line revenues and bottom-line profits simultaneously, with a focus on portfolio and brand strategy, pricing strategy, value proposition and innovation, and customer and product profitability. Among other benefits, the group can support clients by:

- Developing strategies for expanding their portfolio to capitalize on additional use and shopping occasions.

- Optimizing the link between product pricing, product development and marketing.

- Determining the most efficient path forward through portfolio profitability.

If you're interested in learning more about IRI Growth Consulting, please contact Ray Florio at [email protected].

ABOUT SIMPLE MILLS

Founded in 2012, Simple Mills is a leading provider of better-for-you crackers, cookies, snack bars and baking mixes made with whole-food, nutrient-dense ingredients and nothing artificial, ever. In just eight years, the company has disrupted center-aisle grocery categories to become the #1 natural cracker and #1 natural baking brand with distribution in over 20,000 stores nationwide. Its mission is to advance the holistic health of the planet and its people by positively impacting the way food is made. For more information, visit www.simplemills.com.

ABOUT IRI'S MID-MARKET GROWTH PRACTICE

The Mid-Market Growth Practice of IRI provides high-tech and high-touch support for small- to midsize manufacturers. Regardless of company size, IRI has a data solution that drives understanding and growth. Companies benefit from access to all the same tested and proven solutions offered to IRI global partners, enabling companies of all sizes to democratize data, streamline analytics and, ultimately, win in the marketplace. For more information on IRI's comprehensive portfolio of solutions specifically crafted for small- and midsized brands, please contact Robert Porod at [email protected].

IRI Contact:

Shelley Hughes

Email: [email protected]

Phone: +1 312-474-3675

Vestar VII Leads Growth Equity Investment In Friday Health Plans

Denver, April 01, 2021 (GLOBE NEWSWIRE) -- Friday Health Plans, Inc. (“Friday”), a Denver-based health insurance holding company, announced today that it has signed an agreement to receive a $100 million equity investment led by Vestar Capital Partners, a leading U.S. middle-market private equity firm. Leadenhall Capital Partners, a London-based insurance-focused investment manager, will provide an additional $60 million in debt financing. Following robust membership growth of more than 400% in 2021, Friday will leverage the additional funds to expand into new markets with a focus on technology-driven individual and small-group health insurance.

“This funding will not only allow us to offer health plans to more people, but will also accelerate Friday’s technology innovation,” said Sal Gentile, CEO of Friday Health Plans. “Friday was built specifically for individuals seeking simplicity, practical health benefits, and great service – all at an affordable price. We’re able to offer that through a combination of efficient operational execution and consumer-centric technology.”

Friday currently serves more than 70,000 members in Colorado, New Mexico, Nevada and Texas, with plans to expand its offerings into multiple new states each year. Most of Friday’s health plans include $0 primary care visits, $0 mental health counseling, free generic drugs and free telehealth visits. Consumers can purchase the plans on the national or state-based health exchanges, through brokers, or directly on Friday’s website.

“Friday has proven its ability to run an efficient, technology-driven health plan in the consumer health insurance market, and with our investment, we’re excited to support the company as it grows its footprint,” said Norm Alpert, Co-President and Co-Founder of Vestar Capital Partners. “There’s great demand for affordable, customer-driven insurance, and expanding nationwide will help bring better insurance options to those who need it most.”

"Leadenhall is delighted to continue to support and further expand its successful partnership as Friday Health Plans grows its business," said Tom Spreutels, Head of Origination at Leadenhall Capital Partners. “We are equally pleased to be supporting Friday as an innovative provider of affordable health insurance, bringing their plans to a wider group of individuals.”

Friday Health Plans was started in 2015 by Mr. Gentile and David Pinkert, two health technology industry veterans. After the passage of the Affordable Care Act, the pair wanted to start a simpler, friendlier health insurance company, better designed for consumers not receiving health insurance from their employer.

With headquarters in Denver, Friday Health Plans has grown exponentially through acquisition and organic growth. In 2017, the company acquired Colorado Choice Health Plans, a 45-year-old company located in Alamosa, CO. Friday continues to operate in Alamosa and has grown its employee base there to more than 175 people.

Closing of the investment is expected to occur within 90 days and is contingent upon regulatory approval and the satisfaction of certain closing conditions. This funding follows $50 million in institutional funding Friday received from Peloton Equity, Leadenhall Capital Partners and the Colorado Impact Fund in 2019.

TripleTree, LLC acted as the exclusive financial advisor to Friday Health Plans for this transaction.

About Friday Health Plans

Friday Health Plans is purpose-built specifically for people and small businesses who buy their own health insurance. The company focuses on overall simplicity to offer affordable health plans with benefits that help members stay healthy and cover them if they get sick or hurt. Operational efficiency, top-notch customer service, and smart technology are core to Friday’s consumer-centric approach. All insurance plans and services are offered and administered through licensed subsidiaries of Friday Health Plans, Inc. For more information and to find a health plan, visit www.fridayhealthplans.com.

About Vestar Capital Partners

Vestar Capital Partners is a leading U.S. middle-market private equity firm specializing in management buyouts and growth capital investments. Vestar invests and collaborates with incumbent management teams and private owners to build long-term enterprise value, with a focus on Consumer, Business & Technology Services and Healthcare. Since its founding in 1988, Vestar funds have invested $7 billion in 83 companies – as well as more than 200 add-on acquisitions – with a total value of approximately $50 billion. For more information on Vestar, please visit www.vestarcapital.com.

About Leadenhall Capital Partners

Leadenhall Capital Partners is a London, UK-based institutional investment manager focused on managing life and non-life insurance linked investments with over US$6.4bn assets under management, with offices in the UK, Bermuda and the United States. Established in November 2008, Leadenhall Capital Partners has made over 125 investments in companies at various stages of their growth cycle, and at various points in the capital structure. Leadenhall has the expertise to identify promising investment opportunities whilst also backing companies which may provide access to attractive life and health risks for its investment portfolios. For additional information on Leadenhall, please visit www.leadenhallcp.com

Healthgrades Announces Appointment of Jovan Willford as Chief Executive Officer to Lead New Phase of Growth

DENVER--(BUSINESS WIRE)--Healthgrades today announced the appointment of Jovan Willford as its Chief Executive Officer and a member of its Board of Directors, effective immediately. Mr. Willford brings more than 20 years’ experience in healthcare technology and advanced analytics as a dynamic leader known for growth, transformation and strong operational focus. Rob Draughon, who has served as Healthgrades CEO since 2018 and its President and/or CFO since 2012, will assume the role of CEO of Healthgrades Marketplace division, reporting directly to Mr. Willford.

“The addition of Jovan to our leadership team comes at a critical juncture in Healthgrades' growth as we evolve our strategy and solutions to meet the changing needs of consumers, physicians, health systems and life sciences companies we serve. Given Jovan’s track record, breadth of healthcare experience and deep understanding of software, data and analytics, we are confident that Jovan will further accelerate the company’s existing growth trajectory,” said Roger Holstein, Board Member, Healthgrades and Managing Director, Vestar Capital Partners.

Recently, Healthgrades has evolved and organized into two distinct divisions: Platform and Marketplace. With the launch of the Hg Mercury platform, the Company has become a leading enterprise software and data-as-a-service platform, employed by more than 1,500 hospitals to drive patient engagement and physician alignment. With healthgrades.com audience growth at 20% annually, the Company continues to be the leading patient and provider marketplace, where America comes to find the right doctor, the right hospital and the right care.

Said Jovan Willford, CEO, Healthgrades: “The breadth and depth of Healthgrades’ offerings is unmatched in the industry. With our consumer reach and insights, plus our patient and provider engagement platform designed to help health systems accelerate growth, Healthgrades sits at the center of the healthcare ecosystem. I look forward to working with Rob and the rest of the leadership team to build on our success and deliver Healthgrades’ next wave of growth and transformation.”

“Under Rob’s leadership, we expanded and evolved our business. He led the acquisition and integration of Influence Health and Evariant, which have been essential to creating the enterprise software and data platform, Hg Mercury. Now, in this new role, Rob will focus his efforts on realizing the full potential of Healthgrades.com and the Marketplace division, placing renewed emphasis on differentiating providers on the basis of satisfaction, experience and outcomes, and soon cost -- in order to guide consumers to the right doctor, right hospital and right care,” said Norm Alpert, Chairman of the Board, Healthgrades and Co-President and Founding Partner, Vestar Capital Partners.

Most recently, Mr. Willford served as SVP and GM of U.S. Commercial Solutions at IQVIA, delivering technology and advanced analytic solutions to enable commercial capabilities of life sciences organizations. Throughout his tenure at IQVIA, Jovan served in a variety of key leadership positions focused on analytics and technology innovation, including Senior Vice President & Global Head of Clinical Functional Service Provider (FSP) across 72 countries, global head of the industry-defining Quintiles-IMS merger and launching of innovative real-world evidence business units in North America and Asia. Previously, Mr. Willford served as a consultant at Booz & Company, Katzenbach Partners, and Accenture.

About Healthgrades:

At Healthgrades, we help millions of consumers find and connect with the right doctor, right hospital, and right care. Healthgrades.com is the leading marketplace connecting patients and providers. We make healthcare more accessible and transparent for consumers by differentiating providers on the basis of patient satisfaction, physician experience and hospital outcomes. Our Healthgrades Platform division works with the nation’s leading health systems to improve patient engagement and strengthen physician alignment, driving measurable financial outcomes. Hg Mercury is a comprehensive data and software as a services platform that delivers insights and communications solutions which drive patient engagement and physician alignment and integrate seamlessly with the health system’s broader MarTech stack and enterprise ecosystem. At Healthgrades, better health gets a head start.

Contacts

Jen Newman

Liz Austin

IRI Announces Google Executive and CPG Advertising Leader Kirk Perry as Next President and CEO

CHICAGO--(BUSINESS WIRE)--IRI®, a fast-growing, innovative, global provider of technology, data, and predictive analytics for the consumer, retail, and media sectors, today announced the appointment of Kirk Perry, Google’s President of Global Client & Agency Solutions, as President and CEO and a member of its Board of Directors, effective May 17, 2021. Mr. Perry succeeds Andrew Appel, who has successfully led a transformation of IRI for nearly a decade. Mr. Appel will remain an Advisor to the Company and member of the Board of Directors.

Mr. Perry joins IRI from Google, where he has served as President of Global Client & Agency Solutions since 2013. In that role, Mr. Perry was responsible for driving Google's global revenue with the world’s largest advertisers and advertising agencies, helping the company’s biggest global partners grow their businesses more effectively and efficiently. Prior to joining Google, Mr. Perry spent more than two decades at Procter & Gamble (P&G) in leadership and marketing roles, including most recently as President of P&G Global Family Care, a multi-billion dollar global business which included the Bounty, Charmin and Puffs brands. He also served as Vice President of P&G U.S. Operations and North America Marketing, P&G’s biggest region, with responsibilities that included oversight of the region’s marketing and sales operations organizations. Mr. Perry serves on the Boards of The J.M. Smucker Company and e.l.f. Cosmetics.

“The IRI team, under the leadership of Andrew Appel since 2012, has transformed the Company and developed an excellent track record of partnering with clients to leverage data, technology and cutting-edge ideas for accelerated speed of insight generation, helping clients achieve better business results," said Jeffrey Ansell, Chairman of IRI. "On behalf of the Company and Board of Directors, I'd like to thank Andrew for his outstanding contributions and lasting impact. I'm delighted to welcome Kirk as IRI's next President and CEO. He's an impressive, well-respected leader whose background makes him uniquely suited to understand both the evolving needs of our clients and the power of harnessing data, insights and technology to enable better decision making and superior performance."

Mr. Perry said, “I am honored to lead IRI and its immensely talented team. Having managed and supported some of the world’s largest consumer brands in both the consumer packaged goods and technology industries, I have deep appreciation for IRI’s advanced capabilities and its critical role as an insights leader in the industry amidst a dynamic and evolving consumer and marketing landscape. I look forward to building on IRI’s success, market position, and competitive advantages to deepen its connection with clients, ensuring the Company becomes an even more valuable partner to companies seeking to drive growth.”

“It has been a great privilege to lead this incredible company for nearly a decade and work alongside the most talented, hard-working and good-hearted colleagues,” said Mr. Appel. “I’m tremendously proud of what the IRI team has accomplished to date, and I am certain that the Company’s best years are ahead as IRI builds on its strong momentum. I look forward to contributing to this future as an Advisor and Director while ensuring a smooth transition. I’m confident IRI will be in terrific hands with Kirk, given his impressive track record of client leadership, deep experience in technology and media and passion for people.”

Over the last decade under Mr. Appel's leadership, IRI has undergone a significant transformation of its technology, data and predictive analytics offerings to become the insights partner of choice for leading retailers and CPG manufacturers. Since 2013, the Company has more than doubled revenue. Other key company accomplishments during this time include democratizing Liquid Data, which has become the industry’s leading technology, automation and insights platform; expanding the world’s largest repository of anonymized consumer data; creating the IRI partner ecosystem; transforming IRI’s relationships with retailers; launching a media business; pioneering solutions that leverage AI and machine learning; and strengthening the Company’s ongoing diversity, equity and inclusion efforts, including launching efforts to provide pro bono services to minority-owned CPG start-ups.

About the IRI Partner Ecosystem

IRI fundamentally believes that delivering differentiated growth for clients requires deep, highly integrated partnering with a variety of best-of-breed companies. As such, IRI works closely with a broad range of industry leaders across multiple industries and sectors to create innovative joint solutions, services and access to capabilities to help its clients more effectively collaborate and compete in their various markets and exceed their growth objectives. IRI is committed to its partnership philosophy and continues to actively enhance its open ecosystem of partners through alliances, joint ventures, acquisitions and affiliations. The IRI Partner Ecosystem includes such leading companies as 84.51°, Adobe, The Boston Consulting Group, Comscore, Data Plus Math, Experian, GfK, Gigwalk, Google, Ipsos, Mastercard Advisors, MaxPoint, Omnicom, Oracle, Pinterest, Research Now, Simulmedia, SPINS, Survey Sampling International, Univision, Viant, Yieldbot and others.

About IRI

IRI is a leading provider of big data, predictive analytics and forward-looking insights that help CPG, OTC health care organizations, retailers, financial services and media companies grow their businesses. A confluence of major external events — a change in consumer buying habits, big data coming into its own, advanced analytics and personalized consumer activation — is leading to a seismic shift in drivers of success in all industries. With the largest repository of purchase, media, social, causal and loyalty data, all integrated on an on-demand, cloud-based technology platform, IRI is empowering the personalization revolution, helping to guide its more than 5,000 clients around the world in their quests to remain relentlessly relevant, capture market share, connect with consumers, collaborate with key constituents and deliver market-leading growth. For more information, visit www.iriworldwide.com.

Contacts

IRI Contact:

Shelley Hughes

Email: [email protected]

Phone: +1 312.474.3675

Vestar Portfolio Company, Veritas Collaborative, Announces Merger with The Emily Program

ST. PAUL, Minn. and DURHAM, N.C., Feb. 10, 2021 /PRNewswire/ -- The Emily Program and Veritas Collaborative, two of the nation's leading eating disorders programs, are proud to announce that they are joining forces in a merger of their two strong organizations. Both programs are known for their warm and authentic care for people of all ages and genders across the array of eating disorders diagnoses and industry-leading support for quality standards. The Emily Program and Veritas will retain their brands in their respective markets across the Northwest, Midwest, and Southeast and remain committed to maintaining the highest clinical integrity and standards of care and expanding access to care. The merger is expected to close within 60 days.

"We are so pleased to be part of growing access to care for individuals and families dealing with these treatable, life-threatening illnesses," said Dave Willcutts, The Emily Program's CEO. "Our two companies together will set the standard for comprehensive care from outpatient through inpatient to equip clients and families with the understanding, interventions, and ongoing support they need to achieve recovery. We believe recovery from these fierce illnesses is rooted in relationships, and we are honored to be a part of people's journey to recovery."

"When we founded Veritas, we were guided by a vision to collaboratively increase access to quality care with unyielding passion, and now Veritas has become a health care system serving patients nationally," said Stacie McEntyre, Veritas' founder and vice chair of the Veritas board. "I am delighted that we've arrived at this exciting moment in our organizations' history — the joining of Veritas Collaborative and The Emily Program, to combine our passion to bring more care to more people and continue to drive the standard of care in eating disorders treatment. Together, we are stronger."

Dave Willcutts will serve as the CEO of the merged company to be headquartered in St. Paul, Minnesota. Veritas CEO Mike Browder will transition to the board of directors of the merged company. Chris Durbin, chairman of the Veritas board, will serve as chairman for the merged company, and Dirk Miller, founder of The Emily Program, will serve as founding executive chairman.

Collectively, The Emily Program and Veritas currently have 20 locations across Georgia, Minnesota, Ohio, North Carolina, Pennsylvania, Virginia, and Washington, with outpatient individual, group, and family services; intensive outpatient programs; partial hospital programs; residential programs; and inpatient care — with various gender-inclusive programs focused on addressing the needs of children, adolescents, and adults.

About The Emily Program

The Emily Program's vision is a world of peaceful relationships with food, weight and body image, where everyone with an eating disorder can experience recovery. The Emily Program, headquartered in St. Paul, Minnesota, was founded in 1993 by Dirk Miller, Ph.D., L.P., after his sister Emily recovered from an eating disorder. Recognizing that one size does not fit all, The Emily Program provides exceptional, individualized care for people with eating disorders of all ages and genders leading to recovery from eating disorders, incorporating individual, group, and family therapy, nutrition, psychiatry, medical care, yoga, and more — with locations in Minnesota, Ohio, Pennsylvania, and Washington. If you or someone you know is struggling with an eating disorder, call 1-888-EMILY-77 or visit emilyprogram.com.

About Veritas Collaborative

Veritas Collaborative, based in Durham, North Carolina, is a national healthcare system for the treatment of eating disorders, with locations in Georgia, North Carolina, and Virginia. Veritas provides a full continuum of care for individuals of all ages, including inpatient, acute residential, partial hospitalization, intensive outpatient, outpatient care, and multidisciplinary eating disorders (MED) assessment clinics, in a gender-diverse and inclusive environment. Veritas is determined to change the eating disorders field so that all persons with eating disorders, their families, and their communities have access to best-practice care, ongoing support through our alumni and family advocacy programs, and helpful resources on the journey to recovery. If you or someone you know is struggling with an eating disorder, call 855-875-5812 or visit veritascollaborative.com.

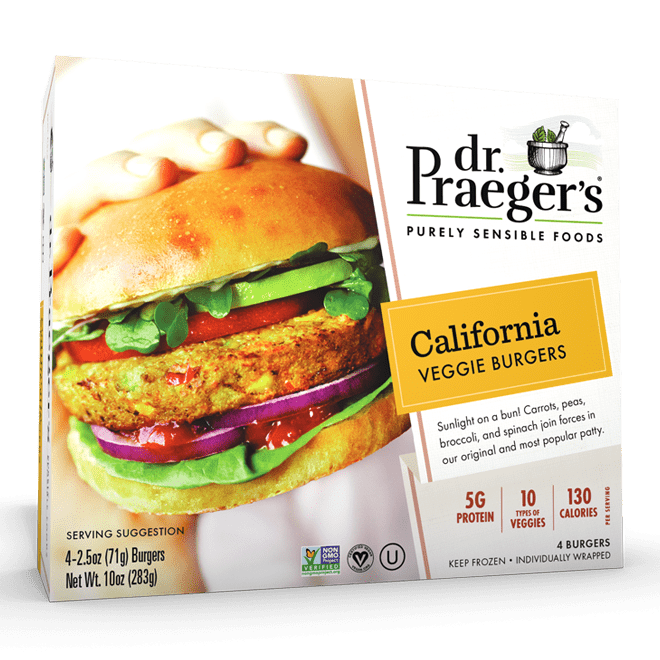

Vestar VII Announces Acquisition of Dr. Praeger's

NEW YORK, Jan. 21, 2021 /PRNewswire/ -- Vestar Capital Partners, a leading U.S. middle-market private equity firm, announced today that it has made a majority growth investment into Dr. Praeger's Sensible Foods, a fast-growing brand specializing in delicious, nutritious plant-based frozen and refrigerated foods made from simple ingredients. Terms of the transaction were not disclosed.

Dr. Praeger's has been a pioneer in the better-for-you food space for more than 25 years. Founded in 1994 by two heart surgeons with a mission to provide nutritious, delicious and convenient frozen foods, Dr. Praeger's offers a range of vegan, vegetarian, gluten free, soy free, Kosher, and non-GMO foods. The company's vegetable-focused lines of veggie burgers, meat alternative burgers, sausages and nuggets, kids Littles, appetizers, snacks, breakfasts and sides are sold in leading food retailers, in stores and online, nationwide.

Headquartered in Elmwood Park, New Jersey, Dr. Praeger's is led by second generation family members Larry Praeger, CEO, and Adam Somberg, President, who will be continuing in their current roles and will remain significant investors in the company.

"We are extremely proud of the high growth better-for-you food brand our families have built," said Mr. Praeger. "When our fathers co-founded the company 25 years ago, they were truly innovators. In today's competitive market, our partnership with Vestar will help provide the financial backing, industry relationships and category expertise to continue to build on our momentum."

"The U.S. better-for-you market has never been stronger, and we are excited to partner with a company that has been at the forefront of this trend and knows the market intimately," said Winston Song, Managing Director and Co-Head of Consumer at Vestar. "Larry and Adam have done a tremendous job building the company and developing new products that speak to today's consumers – flexitarians, vegetarians, vegans and those who seek a healthier lifestyle. We look forward to partnering with the Praeger and Somberg families as well as the senior management team to strategically accelerate growth."

"With Vestar's support, the company aims to launch further product innovations that will continue to deliver healthy, great tasting foods at an attractive price," said Mr. Somberg. "We are fortunate to have some of the most loyal customers in the industry, but with more consumers eating in and looking for better food choices, the timing couldn't be better to team with Vestar to explore ways to expand the brand."

As part of Vestar's investment, Jeffrey Ansell, a 35+ year consumer industry veteran and Senior Advisor to Vestar, will join the Dr. Praeger's board as Chairman. He is currently Chairman of Information Resources Inc. (IRI), a data, insights, and information services company serving the consumer products industry. Mr. Ansell was previously Chairman and CEO of Sun Products, CEO of Pinnacle Foods, and prior to that spent 25 years in leadership positions at Procter & Gamble.

"Larry and Adam have inspired and led an impressive company featuring innovative, healthier food products that align with choices today's consumers are seeking," said Mr. Ansell. "There's great opportunity to build on this strong foundation and grow the Dr. Praeger's brand through increased awareness, trial, distribution and continued innovation. Vestar has a long history of partnering with companies to strengthen these fundamentals and help position them for greater success."

Dr. Praeger's marks the most recent investment in Vestar's long history of investing behind family and founder-owned businesses focused on better-for-you food. The firm's current food investments include Simple Mills, an innovative, market-leading better-for-you cracker, cookie and baking mix brand in the natural and organic channel, Roland Foods, a leading importer and supplier of specialty foods, Nonni's, a leading manufacturer of premium artisanal cookies and baked goods, and Presence Marketing, the leading national sales broker dedicated exclusively to representing natural and organic food, beverage and personal care brands.

Kirkland & Ellis LLP served as legal counsel and Piper Sandler & Co. acted as financial advisor to Vestar. Giannuzzi Lewendon served as legal counsel and J.P. Morgan acted as financial advisor to Dr. Praeger's.

About Dr. Praeger's

For over 25 years, Dr. Praeger's Sensible Foods has offered delicious and convenient frozen food options for the whole family. Founded by two heart surgeons determined to make healthy food easily accessible, the company remains family-owned and operated. Dr. Praeger's is a leader in the all-natural, vegetarian, vegan, gluten free and kosher frozen food categories and has the #1 selling SKU, California Veggie Burger, at Whole Foods as well as a wide range of products including Veggie Burgers, Bowls, Cakes, Puffs and Hash Browns, sustainable Seafood items, kids Littles and more. For more information visit www.drpraegers.com.

About Vestar Capital Partners

Vestar Capital Partners is a leading U.S. middle-market private equity firm specializing in management buyouts and growth capital investments. Vestar invests and collaborates with incumbent management teams and private owners to build long-term enterprise value, with a focus on Consumer, Business & Technology Services and Healthcare. Since its founding in 1988, Vestar funds have invested $7 billion in 83 companies – as well as more than 200 add-on acquisitions – with a total value of approximately $50 billion. For more information on Vestar, please visit www.vestarcapital.com.

Media Contacts:

Lambert & Co.

Jennifer Hurson

(845) 507-0571

[email protected]

Caroline Luz

(203) 656-2829

[email protected]